-

Posts

2905 -

Joined

-

Last visited

-

Days Won

113

Content Type

Profiles

Forums

Articles

Store

Everything posted by Eagle1993

-

I just received a call from my SE helping a unit that was previously chartered by a UMC unit. They are looking at different CO options and are considering our CO (just different branch). The SE said the unit has questions so he was helping check on my CO. Who insurers our trailer? (No one). What meeting space are we provided. (None). What storage space are we provided. (None). How much funding are we provided. (None). I told my SE that our CO signs off on adult leader apps and charter agreement and then we volunteer for their fundraisers. He said ok, he will relay the message. I expect several UMC units will see the brutal reality of what most COs provide... Ink on paper a few times a year. Sad to see the loss of good COs.

-

Looks like you can now request the transcript from March 14 hearing. You need to call: (302)654-8080 This was the day where that BSA leadership summit was discussed.

-

Sure, if they get 6,000,000 more scouts this fall, a lot can change. To be honest, I think a lot of professionals do not know what is coming. Perhaps SEs do, but I'm not convinced DEs. I know one time I sent a note to my DE about something that came out in court. He asked me how I heard and I sent him the document that was listed in the docket. He told me later the SE and council leaders were unaware. The first day of the hearing went through that slide show of the senior leader meeting at Philmont. I wished it ended up on the docket (I'll see off transcript are available). The key slide was basically they cannot wait for consensus.. perhaps the councils do not know what is about to happen.

-

An interesting tidbit from last night's round table

Eagle1993 replied to Armymutt's topic in Issues & Politics

Correct. This is part of the bankruptcy agreement. I think it also goes away for Cub Scouts if the adult is not a parent. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

I was able to find this in the plan: Basically, the COs gave up their rights to insurance if the insurance was one of the "Settling Insurance Companies". The only way for the CO to not give up those rights, is to opt out. So basically, COs have 3 options. Option 1 - Opt Out: No protection from BSA, but they retain insurance rights. How they attempt to cash in will likely require some lawsuits for insurers who settled. So far, I am unaware of any CO going down this path. Option 2 - Participating CO: Protection for post 1976 abuse claims. No protection for pre 1976 abuse claims. What did they give up? They gave up any insurance coverage for abuse claims that came from settling insurers (even pre 1976). Now, they could have their own coverage from an insurance company that did not settle in the bankruptcy. Option 2B - Roman Catholic Only: Protection for post 1976 abuse claims. & protection from pre 1976 abuse claims IF that claim would have been covered by a settling insurer. What did they give up? They gave up any insurance coverage for abuse claims that came from settling insurers (even pre 1976). Now, they could have their own coverage from an insurance company that did not settle in the bankruptcy. Option 3 - Contributing CO: By settling, they are protected from all scouting abuse claims. Actually, by the CO choosing Option 2, they agreed to the insurance settlement and removed any rights they had to the policy. -

I started googling boy scout advertisement images. What surprised me is all of the companies/groups (coke, pepsi, tire companies, bike companies, cigarettes, etc.) that used scouts in their advertisements. GSUSA has a bit of that with their cookies. Part of that is on National to see how the brand could be used. It is amazing to see how scouting is fading into the background. Just one of many examples (I found it interesting for both the history of scouts & how cigarettes used to be marketed).

-

Perhaps before we even begin talking about a marketing issue, I think we need to determine if we have a product issue. While I don't agree with everything Mike says here, I think he makes many valid points. Off The Wall: Death of the Boy Scouts? – Mike Rowe I don't want to hijack this thread, but if the product is stale and lacks relevance, no amount of marketing will make a big impact. When I transferred my CC role to the new volunteer, I met several hours discussing various aspects of the Pack. His feedback to me ... scouting means a lot more to you than anyone else in this Pack. Most parents and youth see it as a nice activity, but family, sports and school rank much higher than scouts. So, if it is really this much work, most parents would be fine seeing the Pack die before putting in the effort you did. So, how does scouts move up that ranking and be equivalent to at least sports? Marketing could help ... but I think relooking at the program and the role scouting can play in the 21st century is probably a better start. From G2SS to merit badge requirements, ranks, uniforms, etc. what does a 21st century scouting organization look like? What can be expected of volunteers? Then, where to get volunteers as I'm not sure the current model works well. Mike Rowe brings up a lot of good points and perhaps that is a good starting point.

-

Local scouting marketing is almost nonexistent. Nothing reaches parents from National or our Local Council. Few Troops/Packs advertise outside yard signs during recruiting. When I was Committee Chair of my pack, I spent a lot of time on Facebook and a bit on Twitter. I promoted my Facebook join scouts night and advertised in our town's rec guide. However, most of that had minimal impact. Outside having social media presence posting pictures, I wouldn't waste much time there. The best recruiting, we had was when we had a popular mom in a grade hand out flyers to all the other moms in that grade. She recruited 30+ Lions that year. My other good recruiting year is when I emailed nearly all parents in the school and let them know about scouts. However, I was scolded by the PTO as I wasn't supposed to use the email list for that purpose. I still have an idea of an annual youth organization expo day. Basically, we rent out our local gym and let all local youth organizations attend. Girl scouts, boy scouts, soccer, baseball, tutors, music groups, etc. Parents/youth attend to see what is available. I've talked with parents and there is a lot of interest. As a parent, I can tell you it is overwhelming. There are so many clubs, organizations, etc. for kids to join, it is tough to keep track. Finally, I do agree that Troops can recruit as well. We have talked about it a lot; however, all of our volunteers are burnt out given existing roles. While it would be great to see more youth in our Troop, we barely get enough volunteer support to get camp sites reserved, collect health forms, support fundraising, etc.

-

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

My guess to help answer your question. Lets say the local Elks club is sued by Johnny scout for some abuse that occurred prior to 1976. Lets say the jury says the Elks club is 50% liable and owes Johnny scout $500K. Per BSA, the BSA did not provide any insurance to any CO pre 1976. So, the Elks would have to look through their own insurance policies from that time. Best case, they find a policy that is valid for abuse and didn't settle. At that point, perhaps some or all of that $500K could come from that insurance policy. To me, the complex part is if they had a policy that did settle. Well, the Elks still owe the $500K per the jury finding. So, perhaps the Elks could try and sue the settlement trust to get whatever they are owed. I'm not sure what else the Elks could do. In reality, I think lawsuits against most COs will be very limited. First, the lawsuits are limited to pre 1976 so victims are likely in the range of mid 50s to 90s. Second, there will be limits from statue of limitations (yes, you can fight that, but it is tough). Third, cases cost a lot of money to fight (on both sides) so lawyers will want to ensure a big pay day if they start a case (and given insurance settlements, may be wary). Now, as you mention, it could really depend on how the CO is organized, insured and how many claimants exist. TCJC will be sued, I have no doubt. However, the Lions Club, VFW, Kiwanis, local churches, etc.? Not sure. Perhaps if they have 10s+ claimants within the right date range & statue of limitations and some sort of assets to go after. We will have to wait and see. Definitely complex. While per the BSA the COs are protected going forward, I fully understand why some (Methodist & Elks) are looking to change their relationship to prevent any further risk. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

This is definitely getting deep in the bankruptcy weeds. I think the path is fairly straight forward if the LDS removes their $250M offer but remains in the plan. Basically, they would be like any other non Methodist/Catholic CO and be given 12 months to negotiate a settlement. After that, they could face lawsuits. It is not clear to me what happens if the LDS pulls that thread, as @Muttsyreferenced, and opts out. How would insurance companies respond if the largest CO decides to risk post 1976 litigation to keep their insurance rights. I honestly do not know, but could imagine it is a more difficult conversation than simply removing the $250M from the plan. Most COs saw scouting as an add on to their normal programing. The abuser wasn't necessarily a member of the CO and most if not all of the contact between the abuser and youth was through scouting. The issue with the LDS is that the relationship between abuser and youth likely crossed between scouts and non scout functions of the church. That makes the scout only releases less valuable to the LDS and could cause them to make decisions that may really disrupt the plan. I'm sure all parties are meeting to figure this out. I'm still convinced that there is a path to closure and we are weeks to a few months from closure. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

Just so it is clear how unlikely the TCJC is an easy fix ... this the judge dedicated an entire section of her opinion to the TCJC settlment. "Throughout this Opinion, I have noted one exception to the appropriateness of the Scouting-Related Releases, namely, the settlement with TCJC...." (about Abuse claim releases unrelated to Scouting) "Both Debtors and TCJC argue that jurisdiction exists and that a full release of TCJC is warranted and supported by the evidence." The judge goes on to show she understands the TCJC and BSA had a unique relationship. "... It is undisputed that Scouting was the official activity program for young men affiliated with the TCJC beginning in the 1920s and that all boys involved with the church were automatically enrolled in Scouting at age 8." "...From this, TCJC concludes that every instance of Abuse that a claimant could allege relating to TCJC necessarily occurred in Scouting." "... I decline to approve the third-party releases over objection because (i) it is unclear that the evidence supports the release, and in any event (ii) the TCJC Settlement stretches third-party releases too far." She goes on to talk about a letter from TCJC to BSA from 2003 describing various cases, including one with mixed claims (abuse occurred both in scouting & non scouting TCJC events). "...(mixed claim case) shows the fallacy of TCJC's conclusion: while all Abuse that occurred during a Scouting activity might also be TCJC-related, the revers is not necessarily true..... Further, while a Local Council has no mission or business other than Scouting, TCJC clearly does." She goes on to state the $250M may not be enough to get the releases requested. In the end... "For these reasons, I decline to approve the TCJC Settlement." I see almost no path to include the current LDS settlement with scouting only releases. Since all kids in LDS were in scouting and scouting volunteers were also church leaders, it is nearly impossible to guarantee the abuse only occurred during scouting activities. I expect we will hear the $250M will be pulled. The BSA does not need the $250M to fund the plan and the LDS, given the relationship with the BSA, likely have limited benefit to obtain scouting only releases. Now, the one issue that could cause delay is if LDS switches to being an opt out CO. If the LDS believes there is no benefit from being protected from post 1976 claims, they may go the opt out route. That would preserve some rights against BSA insurance and BSA (through settlement trust). https://casedocs.omniagentsolutions.com/cmsvol2/pub_47373/9156e828-9e46-448c-bdd0-ae41eab0683b_Chartered_Organization_Notice.pdf So ... if I were the LDS lawyer, I would probably say ... pull back the $250M and become the only Opt Out charter org. That could be a fairly significant development and the BSA and supporting entities may need to negotiate something to prevent the LDS from going down that route. (That is how the Catholic Church got a better pre 1976 deal than other COs). Unfortunately that would lead to some delays. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

From her ruling: ... The nomination of retired Judge Hauser together with the changes to the oversight authority of the STAC go a long way to allay concerns raised by the Certain Insurers. Nonetheless, the record supports the implementation of strong fraud prevention measures in connection with review of Direct Abuse Claims. ..." she goes on "...While no one questions the integrity of the proposed Settlement Trustee, it is appropriate, generally, and in this case in particular given the record, to require that the Settlement Trustee engage in a process that will ferret out any fraudulent claims.... Those procedures will be presented to the court. The STAC will have no consent rights or veto rights with respect to the proposed procedures. In addition to disallowance of a claim, penalties may include seeking the prosecution of the claimant or claimant's attorney for presenting a fraudulent claim in violation of 18 U.S.C. 152 and seeking sanctions from the court." She doesn't trust the STAC or law firms with respect to vetting claims. She brought up how lawyers backpaddled supporting claims with their signature. So, she doesn't want anyone with self interest in charge of the process any more. It was a great move for non fraudulent claimants. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

BSA owns the next actions. 1) They need to meeting with LDS along with TCC, FCR & Coalition. The LDS will not have any releases for non-scouting abuse (as they wanted if the vicitim/abuser were in scouts regardless of setting). The LDS will need to choose ... be part of the plan with revised releases or leave the plan. 2) BSA to discuss with TCC, FCR & Coalition if they are ok with lack of findings supporting TDPs. 3) BSA to meet with settling insurers that covered Guam. See if they are ok proceeding or if the BSA needs to go to the Guam Archdiocese bankruptcy court and fight to free that insurance policy from the stay. 4) BSA to meet with various parties about non abuse claims & lack of releases. 5) BSA to clean up some language that had some minor issues. In terms of timing ... it really depends on the settling insurers, TCC, Coalition and FCR and how significant they see the changes are to the plan. The LDS portion was only going to LDS claimants, so that helps limit the impact a bit. My hope is that we see an updated plan in a few weeks that addresses the judge's concerns. The judge will allow objections to the changes and then a hearing. Perhaps a ruling a few days later. I think the big news is that the overall structure of the plan is fine. Most of the major objections were overruled. She telegraphed the exact issues and hinted at a path to fix (for example ... she said the plan is fully funded without LDS ... hint hint). For CSA victims, unfortunately, as the TCC has said, this is only the first step. Once confirmed, there will be appeal(s) that could take a few months. Post appeal ... then the trust ramps up. They have to create a process to vet claims (as they were not vetted well as part of bankruptcy). That process must be approved by bankruptcy court. Unfortunately, it looks like it will be a while before payments are made. I'm sure the TCC will update until the trustee takes over. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

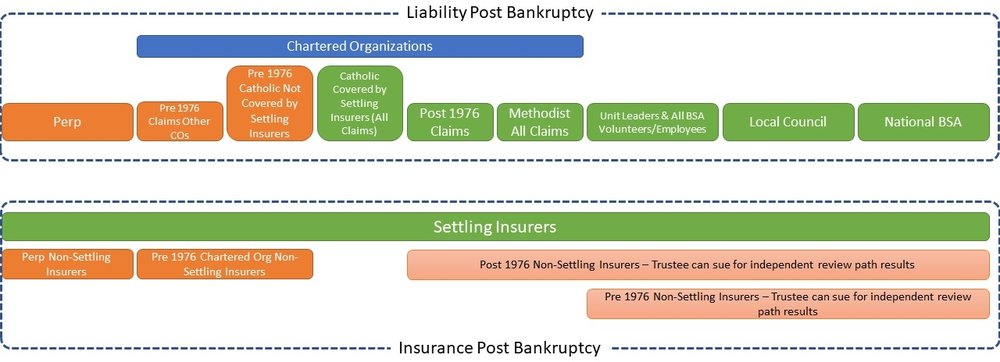

I'll attempt to explain my understanding of abuse claims going forward. This is for child sex abuse claims related to scouting that occurred prior to February 2020. This has nothing to do post Feb 2020 nor non abuse claims. I look at this under two umbrellas. One is liability and the other is insurance. The liability is the individual or organization that pays under tort. For example, for any case, there could be liability ranging from parent, perp, unit leaders, chartered org, local council and national BSA. Depending on a specific case, a jury could assign liability to any one of these by %. Insurance is issued to institutions. Depending on policy language, they could be on the hook to pay; however, the requirement to pay is really based on the tort decision. If you are under insured or your insurance is already spent, you still need to pay or file bankruptcy (and then pay what you can). See the image below for my understanding. Green = fully covered post-bankruptcy. Orange = not covered and could be sued 12 months post bankruptcy (in bankruptcy, COs are given 12 months to settle). Pink = specifically targeted in plan for trustee to go after. Note that I left LDS out as the judge rejected their settlement. So, liability wise: Protected from future lawsuits: National, LCs and Methodist All COs are protected post 1976 claims Catholics if the claim would have been covered by a settling insurer Not protected from future lawsuits Perps Chartered orgs (excluding Methodists & Catholics) for pre 1976 claims Catholics from pre 1976 claims if those claims were not already covered by settling insurers Insurance summary: Settling insurers (regardless of who they insured) cannot be pursued for any coverage Non settling insurers of perp could be pursued (by suing perp) Non settling insurers of COs could be pursued for pre 1976 claims (by suing CO) Post 1976 claims - Trustee will pursue non settling insurers for liability of CO, LC, National & volunteers) - As policy covered COs though National Pre 1976 claims - Trustee will pursue non settling insurers for liability of LC, National & Volunteers - As policy only covered LCs & National Hope this helps. Let me know if you see issues or have questions as it is confusing. I think the interesting point was the Catholic Church who managed to get coverage if their insurance settled. All other COs lost that coverage by being a participating CO (which gave them protection post 1976) but gave them no backstop pre 1976. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

The insurers were clear that their payments cover any liability they faced with respect to scouting abuse. That is why the Roman Catholic Church fought the plan so long as they felt they were losing coverage. Other LCs that didn't settle should have joined the Roman Catholics but likely did not understand the gravity of the situation. The Roman Catholic were able to get a better deal than other LCs by fighting in court. I think the Elks probably recognize the issue they are about to face. I'm not sure if others do yet. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

I don't think so. The LDS negotiation was unique in that it was directed to LDS claimants only. The Methodist also settled which could be used as a benchmark. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

The judge made it clear the BSA does not need the LDS $250M. She stated there is enough $ in the plan without the LDS contribution. I take that as a signal from her on a path out. BSA is probably best off removing the LDS from the plan. The LDS will face a surge of lawsuits but since they are not a currren CO there will be no negative impact to the BSA. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

Basically the LDS were attempting to clear out all claims where the youth was abused by a scout leader within the LDS. She said that while it is ok to clear out claims from scouting activities, she cannot approve clearing claims where the abuse occurred outside of scouting. LDS will have a tough decision. Do they pay $250M for significant protection or do they prepare for an onslaught of lawsuits. They may face that onslaught regardless. My guess is that they pull the $250M and become a non participating charter org. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

It is not exactly clear to me, but as I understand it ... The proponents of the plan wanted the judge to rule with certain findings supporting the TDPs. That be would give the trustee more leverage when asking non settling insurers to pay up. The bankruptcy judge denied this and basically said it by is up to future courts to decide on a case by case basis. So, it gives the non settling insurers a bit more leverage. As I understand it, the TDPs will still be used, they just carry less weight if they are used in future court cases. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

The way I look at this. 1) BSA and LDS need to talk. LDS likely had 3 options. Walk away from the plan, pay $250M but go with the standard charter releases or try to offer less and go with the standard charter releases. 2) BSA and settling insurers must decide if it is ok to punt on the guam insurance transfer and to accept a few minor changes to the plan. My guess is they do. 3) BSA will likely have to remove many of the 22 groups they included in the plan they didn't notify. It is a risk going forward but they can't delay this further. 4) BSA, TCC and Coalition will have to determine if the ruling on the TDP is ok. Probably not much to be done, it is what it is. The good news is that the BSA has a path to clear get to plan approval. My guess is that it may take a few weeks to a month to update. Then perhaps time for objections to the changes. My hope is by end of September they get plan approval. -

Which BSA properties have you visited this Summer?

Eagle1993 replied to Cburkhardt's topic in Open Discussion - Program

We were at Bear Paw week 1 with linked Troops. We patrol cooked and while we had some recommendations for the future, overall a good experience. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

She overrules another group of objectors, except for: UST & Jane Doe. They argue section 1129(a)7 is a confirmation requirement. (This is a requirement to show creditors would get at least as much as they would through Chapter 7). BSA said this section doesn't apply to non profits. The judge agrees with UST & Jane Doe. However, I think the point is moot from what I can see. Several certain insurer objections are overruled. Various other issues are punted to the trustee (basically Allianz plans to sue post plan confirmation and the settlement trustee will be the other side of the lawsuit). There is an issue that the judge cannot confirm all 22 categories of person listed in (d) of the defined term Releasing Claim Holders received notice to release their claims. There is an issue with the list of exculpation includes the reorganized debtors & Pachulski Stang. The reoganized debtors do not exist, so they shouldn't be listed. Pachulski Stang can only be listed if the settlement is approved. In addition, debtors must account for setoff and recoupment rights. That is it. I'm not a legal expert, but I expect the biggest issue is TCJC. That was $250M and they will get far less protection than initially planned. Otherwise, most of the remaining issues appear to be easily fixed. My reading was very fast ... so I may have missed something. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

Independent fees ... in general , the judge approves the $20K in fees. However, she wants the following change. If the settlement trust doesn't waive the fee and the claimant is not happy, they can go to the bankruptcy court for review. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

Very minor change required ... "Given the Debtor's intent, the word "negligence" should be added to Art. VII.C.2(c)". Other than that, certain insurer's objections are overruled and she finds the plan in good faith. -

Chapter 11 announced - Part 11 - Judge's Opinion

Eagle1993 replied to Eagle1993's topic in Issues & Politics

"If the plan is confirmed, the confirmation order will provide that the settlement trustee will propose procedures to suss out fraudulent claims taking into account factors she deems appropriate, which can include a cost/benefit analysis. Those procedures will be presented to the court. The STAC will have no consent or veto rights over these procedures. In addition to disallowance of a claim, penalties may include seeking prosecution of the claimant or claimant attorney for representing a fraudulent claim." She seemed VERY upset over what she herd with claim approvals. Basically, if she confirms the plan, before any payouts, she wants to see how the trust will vet claims.